The other week at the Lean Startup Summit I introduced our ROI calculator in a couple of innovation accounting roundtable sessions. The sessions were overbooked in general since innovation accounting and the connection to portfolio management was a topic many were interested in. Most of the people joining the tables were looking for ways to deal with getting allocated budgets and manage top level expectations. This seemd to be a recurring problem.

For this reason I started of by introducing the ROI calculator right away. Starting of the story by having them play with the calculator and having them fill in the actual investments in the amount of innovation initiatives they were doing right now. And the effect of using the same budget on more innovation initiatives. Seeing the numbers actually will help you realize that what others have been saying is actually true.

The Calculator

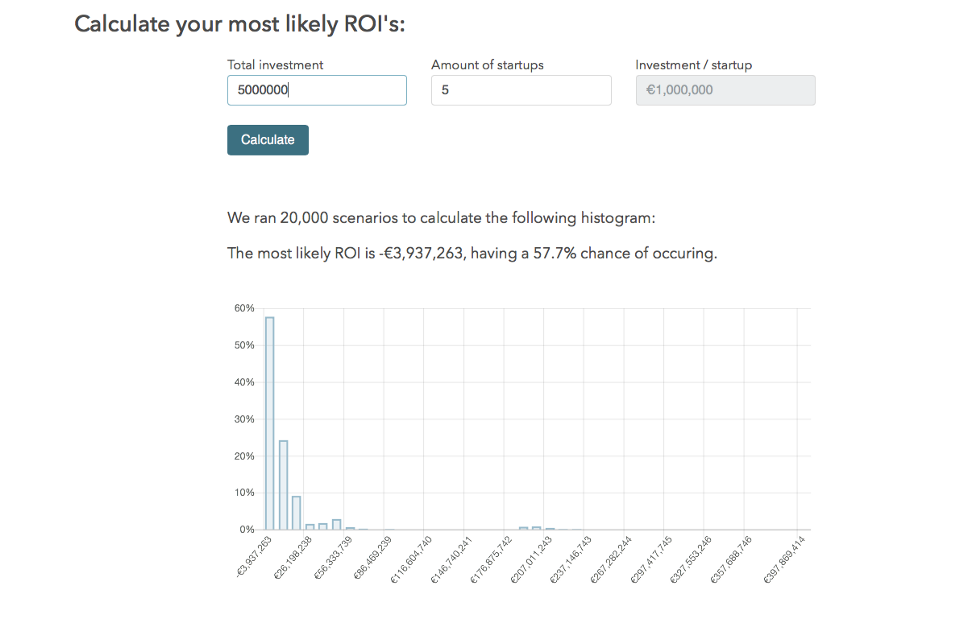

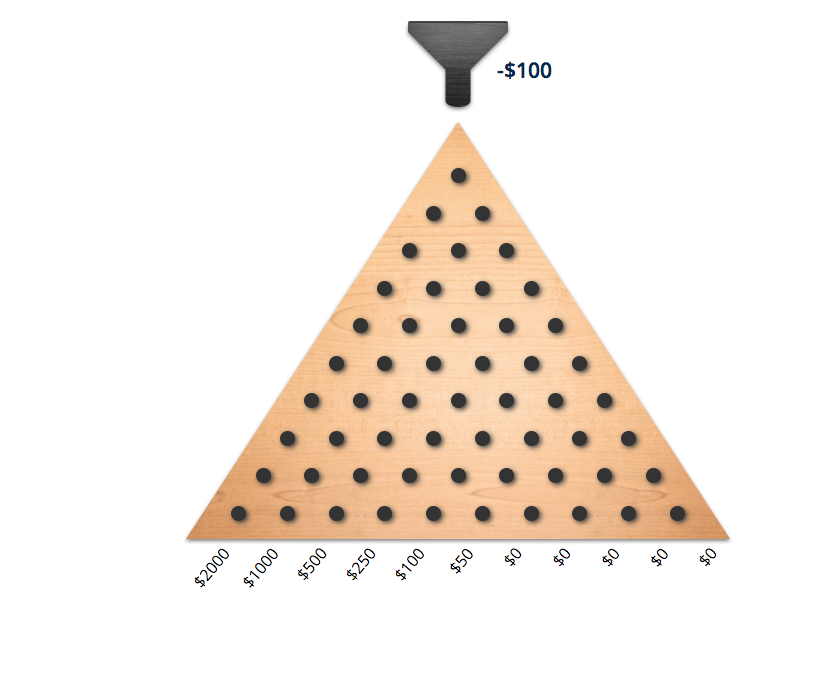

Let me start by explaining the Calculator. As an investor you know that investing in startups is like betting. There is no formula for succes for any startups and even the most promising teams can turn out not to work in the end. VC’s have known that for quite some time. They have learned the hard way, through investing and losing money while only sometimes getting returns. We have taken these numers of VC investments and their returns over the time of some years and looked at the way those returns are distributed over how high and how often they occured.

The calculator itself is using these actual numbers to run scenarios calculating chances by using the Monte Carlo model. So what are the chances of return if I invest this amount of money based on this real data.

If you have a budget of 5 million Euros that you are dividing to give to the 5 most promising internal startups, this will give you a almost 60% chance of losing almost all of that money. Now this is only one scenario but running it again will give you the same sort of outcome almost all of the time.

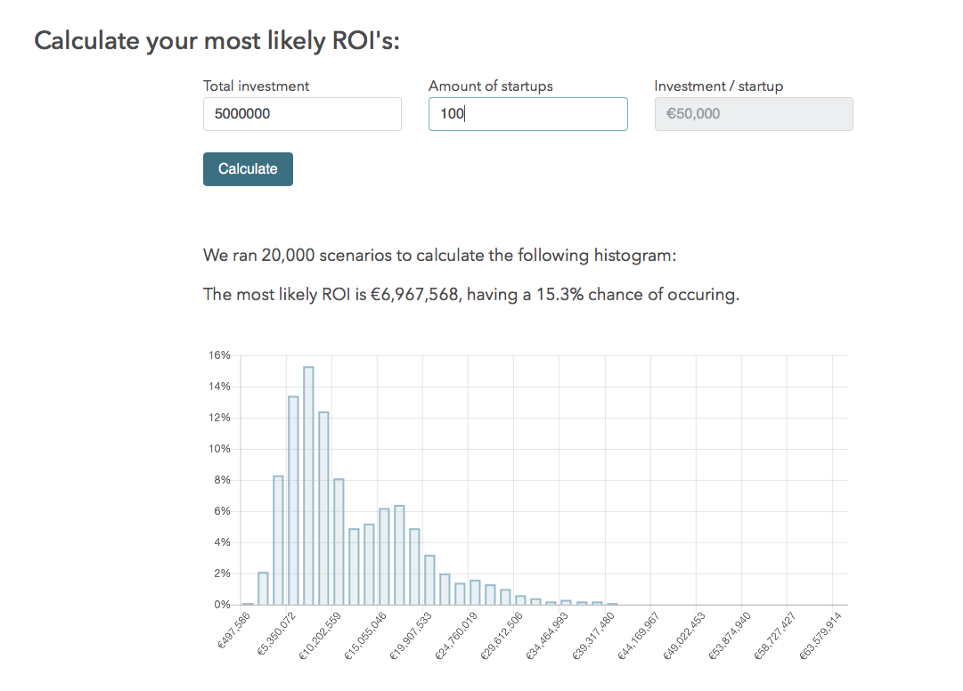

Changing the amount of startups to say 100 and leave the budget the same, will give you a very different outcome.

Investing in more startups will give you a better chance at return than in only a few. Even with the same budget, investing less in each startup. This is good to know, for a healthy innovation portfolio, you need a larger number of startups to begin with. There is nothing you can do to make the portfolio more succesfull. There are however ways to reduce the risk of loss in that portfolio.

Stage Gates

Now that it is clear that you need more balls in the machine, lets look the seperate balls whilst they are going through the process of searching for a business model that works. Plinkromatic is a useful tool to illustrate this.

Each startup is represented a little ball dropping down this board of pins. We have already seen that the chances of returning zero are the biggest so therefor there are more of those on the board. Dropping down a ball will sometimes give you return sometimes not. But if we have a way of stopping the balls that seems to drop towards the zero return, we have a way of spending less money on those and spending more money on the ones that looks like they are going to fall towards return. Stage gating your investments may help you reducing the risk of spending to much on something that probably will not return anything. Probably because it is all still chance.

Now how can we insert those stage gates and control the health of your overall innvation portolio. This is where innovation accounting comes into play.

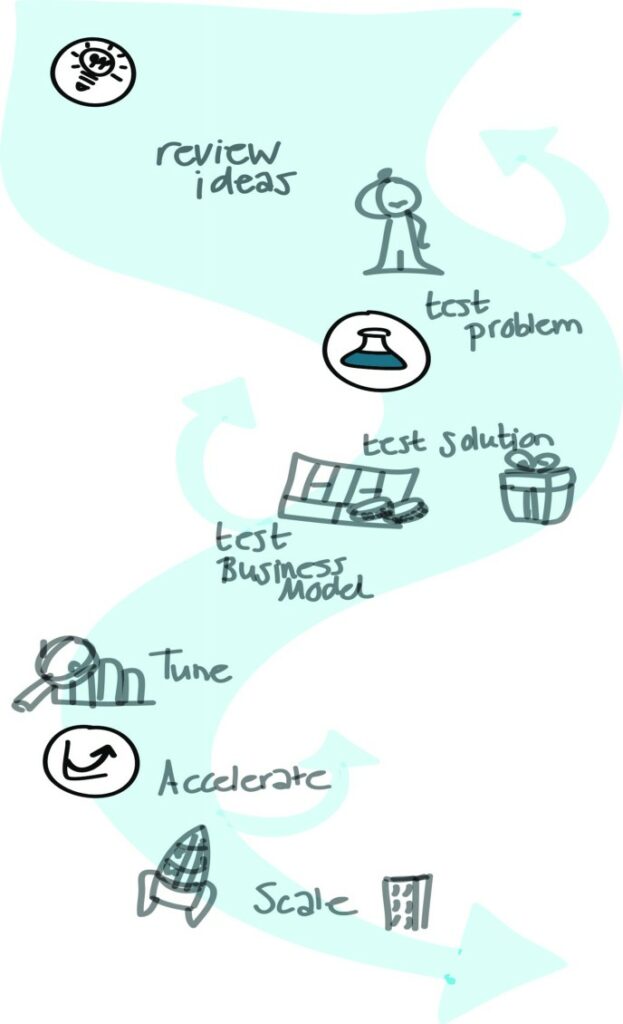

That path of the startup is its lifecycle and only a few will make it till the end. It makes sense to look at the stages in this lifecycle and determine based on what is known at that point in time wheather or not it makes sense to keep exploring on that path.

Asking the right questions

The questions you ask at each stage to determine if a startup can continue, are different for each type of startup as well as different for the stage that they are at. The main goal of these questions (or KPI’s) is to learn and make decisions. At the first stage you want to learn if an idea has the first signs of the promise of something to help people with in a potential market. In additionalignment with the vision and strategy of the company at a global level are important. These innovation KPI’s are never as fixed as they are with financial accounting and project management. They could differ for different projects in different market contexts. It is important to keep in mind why you want to know certain things and what answers will give you a more informed way to make decisions for the continuation of a startup.

Levels of accounting

In terms of innovation accounting we recognize three levels of accounting within a large company.

Lets start with the team level. For individual teams and the coaches assigned to these teams it is important to keep track of the learnings. It is how the team can make decisions to continue something or maybe pivot into a different direction. Coaches can help them and need the input to help them steer and make these decisions.

Since we have established that we need multiple teams, and a way to kill startups that managed to validate that there is nothing to solve, it is important to have reporting at management level. Guarding the stage gates and determining if there is enough data to either go ahead, stop or try again. This is innovation accounting at Management level.

Also important is a clear overview of the overall company portfolio and the part of innovation in that. How is that portfolio performing and how many startups are in what stage. With innovation accounting at strategy level will help make decisions towards a healthy and future facing portfolio. With a business strategy that is connected to the innovation strategy.