I am wrote this article to invite criticism, comment and possible ridicule. My aspiration was to create a framework that combined the three horizons framework from McKinsey with Christensen’s theory of disruptive innovation. I came up with six types of innovation that were pretty lame and needed improving or scrapping. I published this ugly baby of mine, so I could get help from colleagues to make it better.

The feedback I received was great. It made me realize that there is no real need to combine the two frameworks. Instead, the companies can base their innovation work on the three horizon, while considering disruptive innovation within that work. I now have re-written this article in light of the feedback and you can read the new article here. If you are still keen you can have a peak at my ugly baby below, and still leave comments.

____________

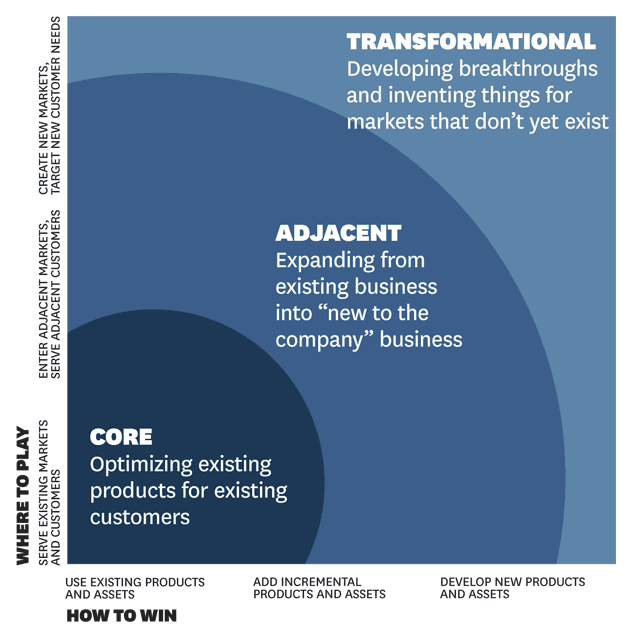

One of my favourite innovation frameworks is Nagji and Tuff’s Innovation Ambition Matrix. Their framework is an adaptation of Ansoff’s Matrix and is based on two main dimensions; products (new products versus existing products) and markets (new markets versus existing markets). Rather than use the binary distinctions that Ansoff uses in his matrix, Nagji and Tuff use a range of values. On the basis of the above two dimensions they distinguish three main types of innovation: core, adjacent and transformational.

- With core innovation company efforts focus on making incremental changes to existing products for existing customers. This can be in the form of new packaging, small redesigns of products or improvements in service. The important point here is that these innovations draw on assets the company already has in place and customers that they already understand well. These are the typical optimizations and improvements that most large companies are very good at.

- With adjacent innovation the company takes something it currently does well and applies it to new markets or to the development of new products for current markets. The point here is that the company is drawing on existing capabilities and putting them to new uses. The entry of adjacent markets and the development of new products using current capabilities can be a stretch; but it is not typically out of reach for many large companies.

- In contrast, transformational innovation focuses on creating new offerings for new markets. In this situation, the company often has to develop new capabilities, products or services, while simultaneously testing these offerings in new markets. This process is the most difficult for large companies to do while they are running their core business. The risks involved and the long horizons for seeing returns are often something large companies do not have an appetite for.

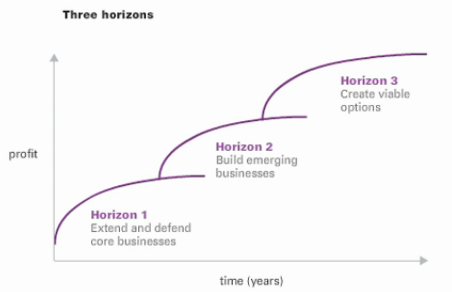

The Innovation Ambition matrix is similar to the three horizons framework from McKinsey. Featured in the seminal book The Alchemy of Growth, this framework provide a lens through which companies can manage for future growth without killing their core products:

- Horizon One represents the core businesses and products that are currently providing profits and cash flow. This is similar to core innovation since the focus is on optimising the performance of the current business models in order to maximize revenue, profits and returns.

- Horizon Two focuses on emerging opportunities that are likely to generate sustainable profits in the near future. Similar to adjacent innovation, the product/services may require some investment but the levels of risk are no longer as substantial. Investment in growing these opportunities will very likely generate substantial new revenues for the company.

- Horizon Three focuses on ground-breaking ideas that may result in profitable growth in the future. These are the ‘crazy plays’ that are bets on future trends and emerging technologies. This is similar to transformational innovation in that the company is thinking about new products for new markets. As such, they could invest in R&D projects, innovation labs or even take stakes in emerging startups.

The point of these frameworks is to illustrate how an established company should view or examine its portfolio of products. It is important that a company has products that cover the three horizons and the three types of innovation. If a portfolio only has core products, then that company is not geared up to be adaptive to changes in its environment.

Disruptive Innovation

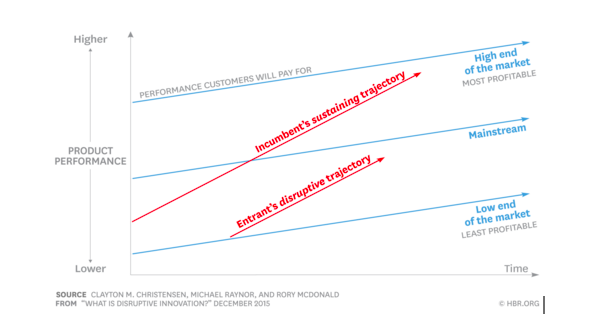

Disruptive innovation, as distinct from sustaining innovation, was first introduced by Clay Christensen in his best-selling book, The Innovator’s Dilemma. Since then, the term ‘disruption’ has been commonly used to describe any situation in which a large incumbent company is replaced by a startup. However, this usage is pretty broad and not representative of Christensen’s original thinking.

It is important to highlight that the sustaining versus disruptive innovation distinction is different from the types of innovation I have described above. Disruptive innovation describes a situation in which smaller companies enter markets by first targeting overlooked lower-end market segments and delivering products with more suitable functionality, often at cheaper prices. New entrants can also focus on new emerging market segments that are currently too small for large companies to pay attention to or care about. The technology serving these nascent markets is often still rudimentary and not to the standard that mainstream customers would appreciate.

In the meantime, large incumbent companies ignore the new entrants and continue to focus on improving their products and services for their most profitable customers. This is what Christensen refers to as sustaining innovation. These business decisions make short-term sense in terms revenues and profits but in the long-term they also create the challenges. This is because, while large companies are focusing on meeting the needs of their most profitable customers, the new entrants continue to improve their products and eventually start to move upmarket.

Disruption is said to have occurred when the new entrants start delivering performance that attracts the large incumbent companies’ more profitable customers. As the new entrants move upmarket, they have an advantage in that they can preserve their lower cost-structures and the customers that made them successful at the lower end of the market. When the customers of the large incumbent companies start buying the new entrant’s product and services, disruption is said to have occurred.

The Six Types Of Innovation

Making the distinction between disruptive innovation and the other types of innovation is not merely theoretical nitpicking. I feel that in order to develop a balanced portfolio, large companies need not only consider the three horizons of innovation. When thinking about their innovation strategies, they also need to be conscious about the how much of their work is focused on low-end and nascent markets. The lower profits and higher risks in these markets may lead large companies to ignore or avoid them, even as they are working across the three horizons of innovation. A focus on disruption directs managers to look in places they would not normally look.

A great example of this is Intel’s creation of the Celeron processor. As a highly innovative company, Intel has historically pushed the envelope in designing faster and better processors for computers and other devices (e.g. Intel Core i7–4770K). However, after reading and hearing about Christensen’s work in 1997, Andy Grove who was at the time CEO of Intel called in Christensen for a meeting. After listening to Christensen talk, Grove rightly concluded that in addition to the pursuit of better and faster processors, Intel should also create their own low-end products. This gave birth to the highly successful Intel Celeron processor.

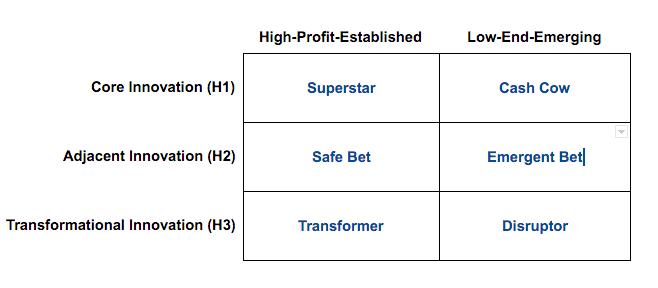

Therefore, I think that companies should be making innovation decisions that consider the whole spectrum of options using three dimensions. The first two dimensions are mentioned above in Nagji and Tuff’s model: How to Win (i.e. New Products versus Existing Products) and Where to Play (i.e. New Markets versus Existing Markets). I think there should be a third dimension to this decision making process that considers disruptive innovation: Where to Start (Low-End or Emerging Markets versus High-Profit or Established Markets). These three dimensions ultimately result in the six types of innovation that are described below.

- Superstar and Cash Cow are both forms of core innovation. The focus here is on making incremental changes to existing products for existing customers. As above, these innovations draw on assets the company already has in place and customers that they already understand well. Innovation can be in the form of new packaging, small redesigns of products or improvements in service. Superstar innovation focuses on the most profitable customer segments by making better and better products for them. In contrast, cash cow innovation focuses on low-end customers by delivering value in an affordable way.

- Safe Bet and Emergent Bet are both forms of adjacent innovation. The focus here in on the company drawing on existing capabilities and putting them to new uses. The company will be taking something it currently does well and applying it to new markets or to the development of new products for current markets. With safe bets, the company is making a decision to do its adjacent innovation in markets that are highly profitable or well established. With emergent bets the company is making a decision to do its adjacent innovation in markets that are low-end or emerging.

- Transformer and Disruptor are both forms of transformational innovation that focus on ground-breaking ideas by creating new offerings for new markets. In this situation, the company often has to develop new capabilities, products or services, while simultaneously testing these offerings in markets it has yet to enter. With transformer innovation, the company develops new products for new markets that are highly profitable or well-established. In contrast, disruptor products are new products for new markets that are low-end or emerging.

A Balanced Portfolio

Understanding the different types of innovation is important because this has practical effects on how managers view their role with regards to their product portfolio. The first advantage of learning these distinctions is that they can provide companies with a language that they can use in a consistent way within their organization. Using the same language means that managers and teams can easily communicate about products and where they sit within the portfolio.

However, the ultimate goal is to help companies achieve a balance in their portfolio. A balanced portfolio is one in which a company has products and service that cover the three horizons of innovation, and considers disruptive innovation as well.

________________